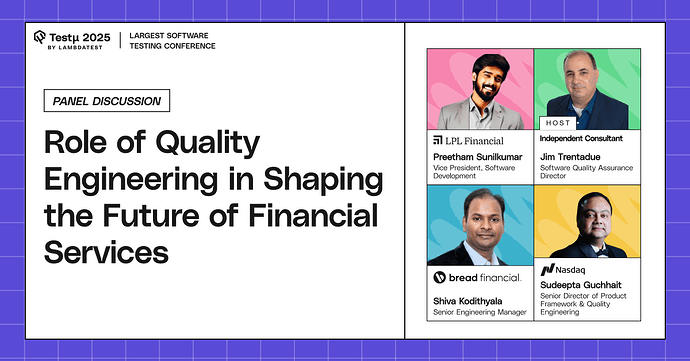

Join Preetham Sunilkumar (LPL Financial), Shiva Krishna Kodithyala(Senior Engineering Manager), and Sudeepta Guchhait(Nasdaq AB, Sweden) as they discuss how quality engineering is shaping the future of financial services.

Learn how top QE leaders integrate automation, DevOps, and continuous testing to deliver secure, reliable, and compliant software in highly regulated environments.

Discover strategies for optimizing testing processes, managing risk, and enabling fast, customer-centric financial services through innovation and QE best practices.

Don’t miss out, book your free spot now

Don’t miss out, book your free spot now

How can QA teams balance the speed of delivery with the need for strict compliance and regulatory requirements in financial applications?

What are key challenges and best practices for incorporating QE practices within the existing infrastructure of legacy financial systems, rather than replacing them entirely?

In 5–10 years, what will Quality Engineering look like in finance? Will blockchain, quantum computing, or something else reshape how you test?

DevOps and testing early are buzzwords, but how do QE teams actually work with devs, product managers, and ops to catch issues before they hit production?

How practical are DevOps skill based AI ML models in insurance/financial space in the context of QE skill set currently prevailing in market place.

Are you currently implementing Compliance as Code in your pipelines?

At what pace is financial tech space embracing the AI /ML space? Is there a lot of leadership and discussion drag that happens on deciding a tool set or new processes.

With so many real time transactions, how do you ensure your data is always timely, accurate, complete, and consistent? How is AI helping you accomplish this?

How can QE be used to build and maintain trust with customers by enabling seamless and secure digital experiences, such as with mobile banking and digital wallets?

How can API governance be integrated with QE practices to reduce compliance risks?

Can QE effectively address the heightened cybersecurity risks and data security challenges associated with interconnected IoT devices and systems?

How do you see QE evolving with the rise of digital banking, fintech, and embedded finance?

Financial systems handle millions of transactions, how do you stress-test systems for reliability and resilience?

What KPIs or metrics best indicate “digital quality” in financial services?

How does QE support personalization and recommendation engines in finance without compromising accuracy?

. What testing strategies help financial firms stay ahead of cybersecurity threats like phishing and ransomware?

As financial services adopt AI and blockchain, what unique quality challenges emerge, and how do we address them?

Can AI-driven testing help proactively detect fraud, anomalies, and compliance issues in financial platforms?

Have any of you seen compliance to The EU AI Act, moving into Quality Engineering Test teams, - to validate and verify both, AI agent-assisted financial transactions functionalities as well as AI governance and regulatory compliance… ?

![]() Don’t miss out, book your free spot now

Don’t miss out, book your free spot now