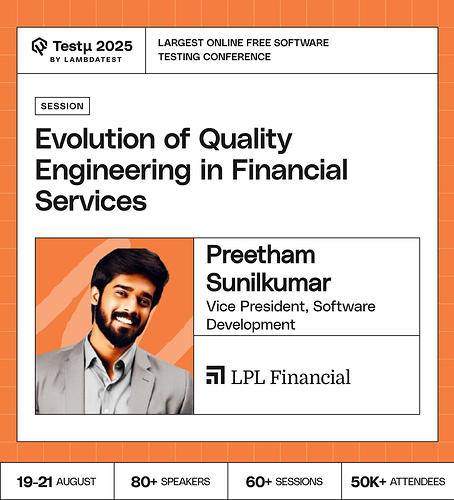

Join Preetham Sunilkumar as he unpacks the evolution of Quality Engineering in financial services from manual testing to AI-driven autonomous intelligence.

Discover how AI is reshaping the QE lifecycle with predictive risk mitigation, hyper-automation, and compliance assurance, enabling teams to build resilient, customer-centric financial products.

Learn practical strategies, case studies, and future-ready approaches to deploy AI in testing, foster collaboration across domains, and upskill teams for the AI-first era of quality.

Don’t miss out, book your free spot now

Don’t miss out, book your free spot now

What unique challenges does financial services QA face compared to other industries, especially with new technologies like AI and blockchain?

In what ways has software quality assurance in the financial sector transformed over time, moving from manual testing practices toward automation-first methodologies?

What makes QA in financial services different from other industries?

What major changes have financial institutions seen as Quality Engineering has progressed from manual testing toward automation-led practices?

How do you balance compliance with fast releases?

How do you see the latest advancements in Generative AI and Large Language Models (LLMs) specifically impacting test creation?

Will we soon be able to generate complex end-to-end test suites from a simple product requirements document?

How do you balance automation with human intuition? In the case studies you reviewed, where was the “human-in-the-loop” most crucial for success?

Autonomous testing introduces a level of abstraction, or a “black box.” What strategies or tools are effective for ensuring the explainability and trustworthiness of AI-driven testing decisions, especially when a critical defect is missed?

For “predictive risk mitigation,” what specific data sources have you found most valuable for the AI models? Is it primarily code churn and historical defect data, or are you also leveraging production monitoring, transaction logs, or even market data?

How has Quality Engineering in financial services evolved from traditional manual testing to today’s automation-first approaches?

What are the key drivers behind the shift from traditional QA to modern QE in banking and fintech?

How have customer expectations influenced QE strategies in financial services?

When AI is used in all phase of software testing and QE, how do you generate metrics to ensure that the quality is done right?

How do we balance speed of delivery with strict compliance and regulation?

What are the most significant advancements in test automation and continuous testing that have enabled financial institutions to achieve faster time-to-market and enhanced software quality?

How has QE played a key role in mitigating the risks associated with modernizing legacy systems while ensuring business continuity in the financial services sector?

With the rise of real-time payments and open banking, how does QE ensure security, performance, and interoperability at scale?

How have fast-evolving regulatory landscapes (such as GDPR, MiCA, PCI DSS) specifically influenced the practices and priorities of Quality Engineering in the financial sector?

In what ways has the evolving competitive landscape, including the rise of fintech companies, spurred innovation and the adoption of more advanced QE practices within traditional financial institutions?

![]() Don’t miss out, book your free spot now

Don’t miss out, book your free spot now